What is actually forex investing and also exactly how does it operate?

Foreign exchange, or even forex, may be detailed as a network of purchasers and sellers, who transmit unit of currency in between each other at a concurred cost. It is the means whereby people, companies as well as main financial institutions turn one currency into one more -- if you have ever journeyed abroad, at that point it is probably you have made a currency deal.

While a bunch of forex is actually performed for efficient functions, the huge large number of unit of currency sale is actually undertaken with the goal of making a profit. The quantity of unit of currency converted each day may make price motions of some unit of currencies extremely inconsistent. It is this volatility that can easily make foreign exchange so desirable to traders: generating a more significant possibility of higher incomes, while likewise increasing the threat.

How carry out currency markets operate?

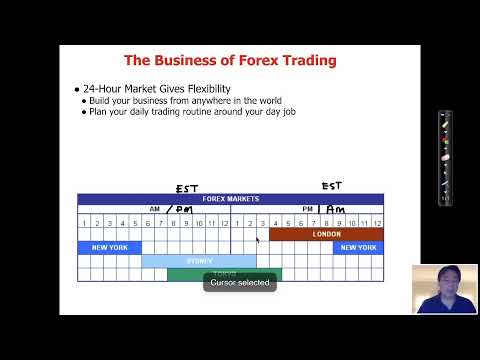

Unlike portions or even products, forex investing carries out certainly not occur on swaps yet directly between 2 parties, in an over-the-counter (OTC) market. The foreign exchange market is run by a worldwide system of financial institutions, spread out around four primary forex investing centres in different time regions: London, New York, Sydney as well as Tokyo. Because there is actually no central place, you may trade forex 24 hours a day.

There are three different kinds of forex market:

- Spot forex market: the bodily swap of an unit of currency set, which takes spot at the exact factor the exchange is settled -- ie 'instantly' -- or within a brief time period

- Forward currency market: a deal is actually conceded to purchase or market a collection quantity of a currency at a defined cost, to be settled down at a collection day in the future or even within a variety of potential dates

- Future foreign exchange market: an arrangement is actually accepted to acquire or even market a collection volume of a specific money at a prepared rate and day later on. Unlike ahead, a futures agreement is lawfully binding.

The majority of traders margin upping on currency costs are going to not organize to take distribution of the currency on its own; instead they create swap price predictions to take perk of price activities in the marketplace.

What is a servile currency?

A servile money is actually the first unit of currency specified in a foreign exchange pair, while the second unit of currency is actually gotten in touch with the quote currency. Forex exchanging regularly involves selling one money to purchase yet another, which is actually why it is priced estimate in sets -- the cost of a forex set is just how much one device of the servile money deserves in the quote currency.

Each currency in the pair is actually provided as a three-letter code, which often tends to be developed of 2 letters that represent the location, as well as one meaning the unit of currency on its own. For example, GBP/USD is an unit of currency pair that includes purchasing the Great British extra pound as well as offering the US dollar.

To maintain factors ordered, most companies split pairs right into the adhering to groups:.

- Major pairs. Seven unit of currencies that compose 80% of international currency trading. Consists Of EUR/USD, USD/JPY, GBP/USD and also USD/CHF.

- Minor pairs. Much less often traded, these often include major currencies versus one another rather of the US buck. Features: EUR/GBP, EUR/CHF, GBP/JPY.

- Exotics. A primary unit of currency versus one from a small or surfacing economy. Consists of: USD/PLN, GBP/MXN, EUR/CZK.

- Regional sets. Pairs classified through area -- like Scandinavia or Australasia. Consists of: EUR/NOK, AUD/NZD, AUS/SGD.

What relocates the forex market?

The forex market is actually composed of currencies from across the globe, which can create foreign exchange rate prophecies hard as there are a lot of factors that could possibly help in rate motions. However, like many monetary markets, currency is actually mainly steered through the forces of source and also requirement, and also it is crucial to get an understanding of the effects that drive price fluctuations right here (in more details - https://www.forexof.com/2019/07/earn-olymp-trade.html).

Reserve banks

Supply is actually handled by main financial institutions, that may reveal actions that will certainly possess a notable effect on their currency's rate. Quantitative soothing, as an example, includes administering even more money in to an economic condition, as well as can induce its currency's cost to fall.

Report

Office banking companies as well as various other financiers usually tend to would like to put their funds in to economies that have a sturdy outlook. Therefore, if a good part of news attacks the markets regarding a specific area, it will definitely urge investment as well as rise requirement for that location's currency.

Unless there is an identical rise in supply for the money, the disparity in between source as well as requirement will definitely cause its cost to improve. Likewise, a part of damaging updates can result in assets to lower as well as lower a currency's price. This is actually why unit of currencies tend to reflect the mentioned economical wellness of the region they exemplify.

Market view

Market sentiment, which is typically in response to the news, can easily additionally play a major function in steering unit of currency costs. If traders believe that an unit of currency is headed in a particular instructions, they will trade appropriately and also may entice others to follow satisfy, boosting or reducing demand.

Just how carries out foreign exchange investing job?

There are a range of different manner ins which you may trade forex, but they all operate the very same technique: through concurrently getting one unit of currency while marketing yet another. Customarily, a whole lot of currency transactions have been actually made via a currency broker, however along with the surge of on-line investing you may take advantage of foreign exchange rate motions utilizing by-products like CFD trading.

CFDs are actually leveraged items, which permit you to open up a placement for a merely a portion of the amount of the field. Unlike non-leveraged items, you do not take ownership of the possession, yet take a placement on whether you assume the market place will increase or become in market value.

Although leveraged products can amplify your revenues, they may likewise amplify reductions if the market relocates versus you.

What is actually the escalate in foreign exchange trading?

The spread is the variation in between the deal rates quotationed for a currency set. Like lots of monetary markets, when you open up a foreign exchange job you'll exist with pair of prices. If you wish to open up a lengthy job, you trade at the purchase price, which is slightly above the market price. If you really want to open up a quick opening, you trade at the sell price -- somewhat below the market place rate.

What is actually a great deal in foreign exchange?

Money are actually traded in whole lots -- sets of unit of currency made use of to standardise foreign exchange fields. As foreign exchange often tends to relocate percentages, whole lots have a tendency to be huge: a regular whole lot is actually 100,000 units of the servile money. Therefore, due to the fact that private traders won't essentially possess 100,000 extra pounds (or even whichever currency they're trading) to put on every business, nearly all currency exchanging is leveraged.

What is actually utilize in foreign exchange?

Make use of is the ways of obtaining exposure to large quantities of currency without possessing to pay for the full market value of your trade upfront. Instead, you place down a tiny deposit, recognized as margin. When you close a leveraged placement, your profit or loss is actually located on the full dimension of the trade.

While that carries out amplify your profits, it additionally carries the threat of boosted losses -- featuring reductions that may surpass your margin. Leveraged trading as a result creates it exceptionally significant to learn just how to manage your threat.

What is actually foreign exchange trading as well as just how does it work?

Foreign exchange, or even overseas exchange, can be explained as a network of shoppers and also sellers, that move unit of currency between one another at an agreed price. It is the methods where people, providers and reserve banks change one currency right into yet another -- if you have ever journeyed abroad, after that it is actually very likely you have created a currency purchase.

While a considerable amount of forex is actually done for useful purposes, the huge bulk of unit of currency conversion is actually embarked on with the intention of making a revenue. The amount of money changed each day can easily bring in rate movements of some currencies remarkably unpredictable. It is this dryness that can create currency so appealing to investors: causing a better chance of high revenues, while additionally boosting the danger.

Just how do unit of currency markets function?

Unlike shares or assets, currency investing carries out certainly not happen on swaps yet directly between pair of celebrations, in a non-prescription (OTC) market. The currency market is actually run through a global network of banking companies, spread out throughout four significant foreign exchange exchanging centres in various time areas: London, New York, Sydney as well as Tokyo. Due to the fact that there is actually no main area, you can easily trade currency 24 hrs a time.

There are 3 various types of forex market:

- Spot foreign exchange market: the bodily substitution of a currency pair, which takes place at the particular factor the exchange is actually worked out -- ie 'instantly' -- or within a quick time period

- Forward currency market: an agreement is actually accepted to purchase or market a collection amount of a currency at an indicated price, to be actually settled at a set day later on or even within an array of potential dates

- Future foreign exchange market: a contract is acknowledged to purchase or market a collection quantity of a given unit of currency at a prepared cost and also time down the road. Unlike forwards, a futures deal is actually lawfully binding.

Most traders sticking neck out on forex rates will not consider to take delivery of the unit of currency on its own; rather they create foreign exchange rate forecasts to make use of price actions in the marketplace.

What is actually a base money?

A servile unit of currency is the first currency provided in a currency set, while the second currency is actually gotten in touch with the quote unit of currency. Foreign exchange trading constantly entails offering one money so as to buy yet another, which is actually why it is priced estimate in sets -- the price of a forex pair is the amount of one unit of the base currency is actually worth in the quote currency.

Each currency in the set is actually provided as a three-letter code, which tends to become developed of 2 characters that mean the area, and one representing the unit of currency itself. As an example, GBP/USD is actually an unit of currency pair that includes buying the Great British pound and selling the US dollar.

To keep points ordered, a lot of suppliers divided pairs into the observing categories:.

- Major sets. 7 money that create up 80% of global forex exchanging. Features EUR/USD, USD/JPY, GBP/USD as well as USD/CHF.

- Minor pairs. Less regularly traded, these frequently include primary unit of currencies against each other rather than the US dollar. Consists of: EUR/GBP, EUR/CHF, GBP/JPY.

- Exotics. A primary currency versus one from a little or even arising economic climate. Includes: USD/PLN, GBP/MXN, EUR/CZK.

- Regional pairs. Sets classified through region -- including Scandinavia or even Australasia. Includes: EUR/NOK, AUD/NZD, AUS/SGD.

What moves the currency market?

The forex market is actually composed of unit of currencies coming from all over the world, which may create currency exchange rate forecasts hard as there are many factors that might help in rate movements. Nevertheless, like many financial markets, currency is actually predominantly steered by the forces of source and requirement, and it is necessary to acquire an understanding of the impacts that steer cost variations below (in more details - https://www.forexof.com/p/create-olymptrade-account.html).

Central financial institutions

Source is actually handled through central banking companies, that can introduce actions that will have a considerable effect on their money's price. Quantitative easing, as an example, includes administering more funds in to an economic climate, and can easily create its own currency's price to go down.

News discloses

Commercial banking companies as well as various other investors usually tend to intend to place their capital into economic conditions that have a sturdy outlook. So, if a favorable item of information reaches the market places about a specific area, it will encourage financial investment and also boost requirement for that location's currency.

Unless there is a parallel rise in supply for the money, the variation in between supply and need will create its price to boost. Similarly, an item of bad updates may result in investment to minimize and also reduce a currency's rate. This is actually why money often tend to demonstrate the mentioned economic wellness of the location they embody.

Market view

Market conviction, which frequents reaction to the headlines, can also participate in a major job in steering money costs. If investors believe that an unit of currency is moved in a specific direction, they will trade appropriately as well as might entice others to do the same, boosting or minimizing requirement.

Exactly how performs forex exchanging work?

There are actually a selection of different manner ins which you may trade forex, but they all work similarly: by concurrently acquiring one money while offering an additional. Generally, a considerable amount of forex transactions have actually been actually made using a forex broker, yet along with the growth of on the internet trading you may benefit from forex price activities using derivatives like CFD investing.

CFDs are actually leveraged products, which allow you to open up a setting for a merely a portion of the amount of the business. Unlike non-leveraged items, you don't take possession of the property, yet take a setting on whether you believe the market place is going to rise or join worth.

Although leveraged products may amplify your profits, they can easily also magnify reductions if the market moves versus you.

What is the spreading in currency trading?

The escalate is actually the variation in between the purchase as well as offer estimate for a forex pair. Like lots of monetary markets, when you open a currency job you'll appear with two costs. If you intend to open up a lengthy position, you trade at the purchase cost, which is actually slightly over the marketplace cost. If you would like to open a quick opening, you trade at the sell rate -- a little listed below the marketplace rate.

What is actually a lot in currency?

Currencies are stocked lots -- batches of money used to standardise foreign exchange professions. As forex usually tends to relocate percentages, lots usually tend to be actually incredibly sizable: a regular whole lot is 100,000 units of the base currency. Thus, given that specific traders won't essentially possess 100,000 extra pounds (or whichever currency they're trading) to put on every business, nearly all foreign exchange exchanging is leveraged.

What is actually utilize in forex?

Take advantage of is actually the ways of acquiring exposure to big amounts of unit of currency without must pay out the total worth of your trade upfront. Instead, you take down a small down payment, called frame. When you close a leveraged setting, your earnings or even reduction is actually based upon the total dimension of the business.

While that does amplify your profits, it also brings the threat of intensified reductions -- featuring losses that can surpass your scope. Leveraged investing as a result creates it extremely essential to find out how to manage your threat.